Momentum in Trading: A Structured Guide

What is Momentum?

Momentum is the rate at which price moves over time. It does not describe direction alone, but the strength behind that direction. Both a slow upward move and a sharp spike travel in the same direction, but one does so with greater momentum. This distinction matters.

A simplified way to think about momentum is as magnitude multiplied by time. The larger the distance price covers in a shorter period, the stronger the move. In contrast, a slow and persistent drift reflects weaker momentum.

Momentum = Magnitude × Time

Why Momentum Matters

Momentum corresponds to the underlying buying or selling pressure in the market. Increased momentum indicates that price is moving more decisive, because one side of order flow has become more dominant.

In markets, strong moves tend to be followed by more strong moves. This creates an effect where trends or large swings can develop. A spike in momentum, initiated from a range expansion, can signal the beginning of such a phase. This shift from low activity to directional imbalance is where opportunities become viable.

The Two Sides of Momentum

An increase in momentum can lead to different outcomes. It may signal the beginning of a new trend, marking the shift from balance to direction. But in an extended move, the same increase could indicate a climax, followed by exhaustion and a return toward balance.

Both situations can appear similar on the chart but lead to opposite outcomes. Therefore, strong movement alone is not sufficient. The surrounding context matters.

Measurement Techniques

Trading should be based on discretion. It requires interpretation, context, and deliberate decision-making. However, without structure, it risks becoming inconsistent and reactive. Being able to quantify what counts as a strong move makes the process more consistent and repeatable. A trader might look at a chart and believe a move is strong and likely to continue based on a pattern, but without measurable context, this evaluation has limitations.

The steeper the price move on the chart, the stronger the momentum. While not a standardized metric, visual slope offers a quick and intuitive reference. For a more measurable evaluation, what appears meaningful should be compared relative to the asset’s own historical behavior.

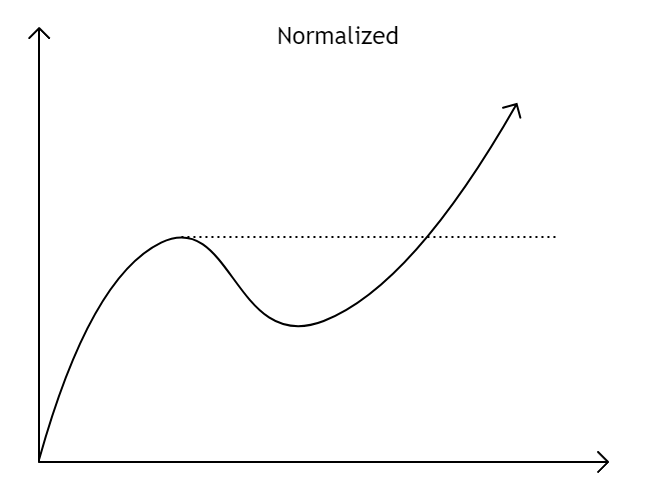

Normalized Momentum

Normalized momentum identifies when the current price reaches a new high or low compared to a historical window. This is the most standardized measurement and adapts well across markets.

- Normalized = Current Price ≥ Maximum Price in Lookback

- Normalized = Current Price ≤ Minimum Price in Lookback

This method shows where price has broken outside previous historical levels, with a common example being a new 52-week high or low.

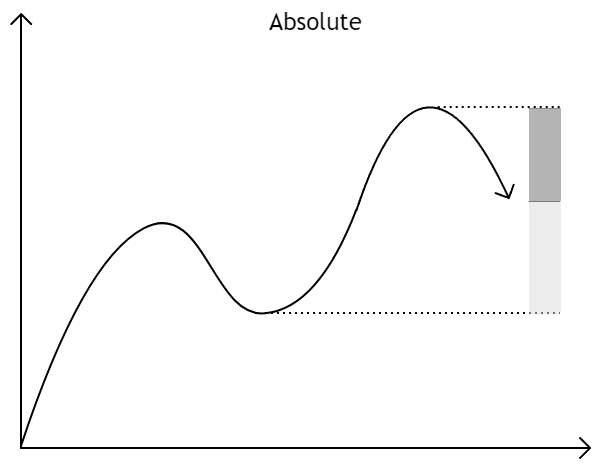

Absolute Momentum

Absolute Momentum measures the price change over a set period. It is based on the difference between the current price and the lowest price in the lookback period for upside momentum, or the highest price for downside momentum.

- Current Price − Lowest Price in Lookback ≥ X

- Highest Price in Lookback − Current Price ≥ X

This version calculates raw price change, which is suitable for higher-priced stocks. A more common and universal variation is a percentage-based calculation:

- (Current Price − Lowest Price in LB) ÷ Lowest Price in LB ≥ X

- (Highest Price in LB − Current Price) ÷ Highest Price in LB ≥ X

These thresholds can be used to define what counts as a significant move in absolute terms, for example a price that has moved up or down at least 20% over the past month. This method is less standardized across markets.

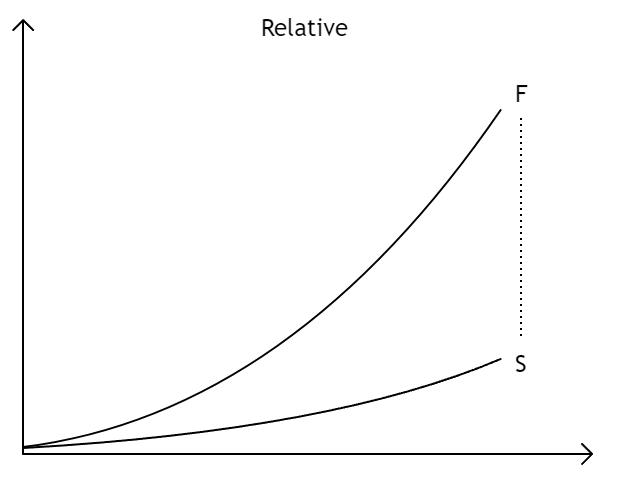

Relative Momentum

Relative Momentum measures the relationship between short-term and longer-term trends by comparing two moving averages. This ratio reflects momentum and quantifies acceleration.

- Relative = (Fast MA − Slow MA) ÷ Slow MA

Another expression of this is a ratio form:

- Fast MA ÷ Slow MA ≥ X

- Fast MA ÷ Slow MA ≤ X

Values above 1 indicate upside momentum, while values below 1 suggest downside momentum. The further the ratio deviates from 1, the stronger the rate of change. For example, 7 MA compared to 65 MA, where the ratio must be above 1.05 or below 0.95. This means the short-term average is at least 5% above or below the long-term to indicate sufficient momentum.

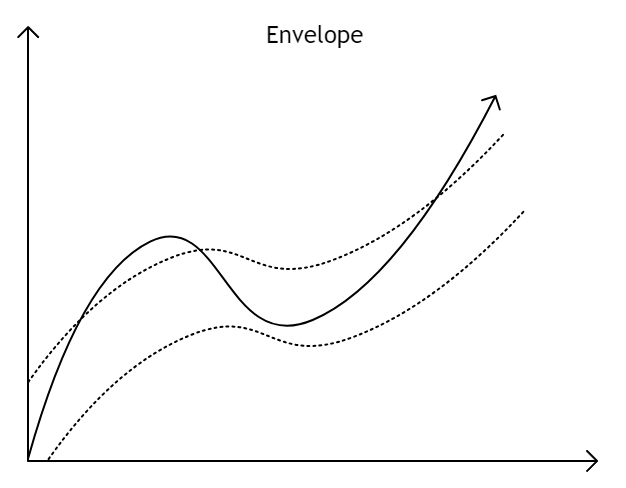

Envelope-Based Momentum

Envelope-Based Momentum evaluates momentum by using a volatility-adjusted band around price. The envelope is constructed with a moving average as the center and bands placed above and below based on a multiple of the ATR. When price touches or exceeds these bands, it could indicate momentum expansion, meaning a strong directional move.

- Upper Band = MA + (Multiplier × ATR)

- Lower Band = MA − (Multiplier × ATR)

As mentioned in an earlier chapter, the envelope can be constructed using a 20-period exponential moving average (EMA) as the center, with bands placed 2.25 times the ATR above and below. This method helps identify when a move is statistically significant relative to recent price behaviour.

Momentum Extreme

Momentum High / Low is an indicator that compares the distance between a fast and slow moving average. The default setting uses a 3-period and 10-period SMA. The indicator tracks the distance between them over a defined lookback period and records when that distance reaches a new high or low. This shows when price is moving with more force compared to recent behavior.

- Momentum Value = Fast MA − Slow MA

- A new momentum high indicates an upside momentum extreme

- A new momentum low indicates a downside momentum extreme

Momentum Conditions: What Is Meaningful?

Two identical price patterns can appear the same in isolation but have different outcomes depending on context. To evaluate momentum, the current move must be compared to what is typical for that market. This determines whether the move is significant or random behavior.

As discussed earlier in the context of deviation, significance comes from context. For example, a move that reaches the outer envelope band could help define expansion, while a ratio-based method like relative momentum can quantify strength compared to longer-term trends.

These techniques can be applied through scans and visual tools to standardize evaluation and support a more consistent approach for interpretation.